Initiating coverage | Textile

April 8, 2011

Siyaram Silk Mills

ACCUMULATE

CMP

`360

A growth yarn...

Target Price

`414

Siyaram Silk Mills (SSM) is one of the leading textile manufacturers in India. The

Investment Period

12 Months

company enjoys a strong brand presence across the country, with brands such as

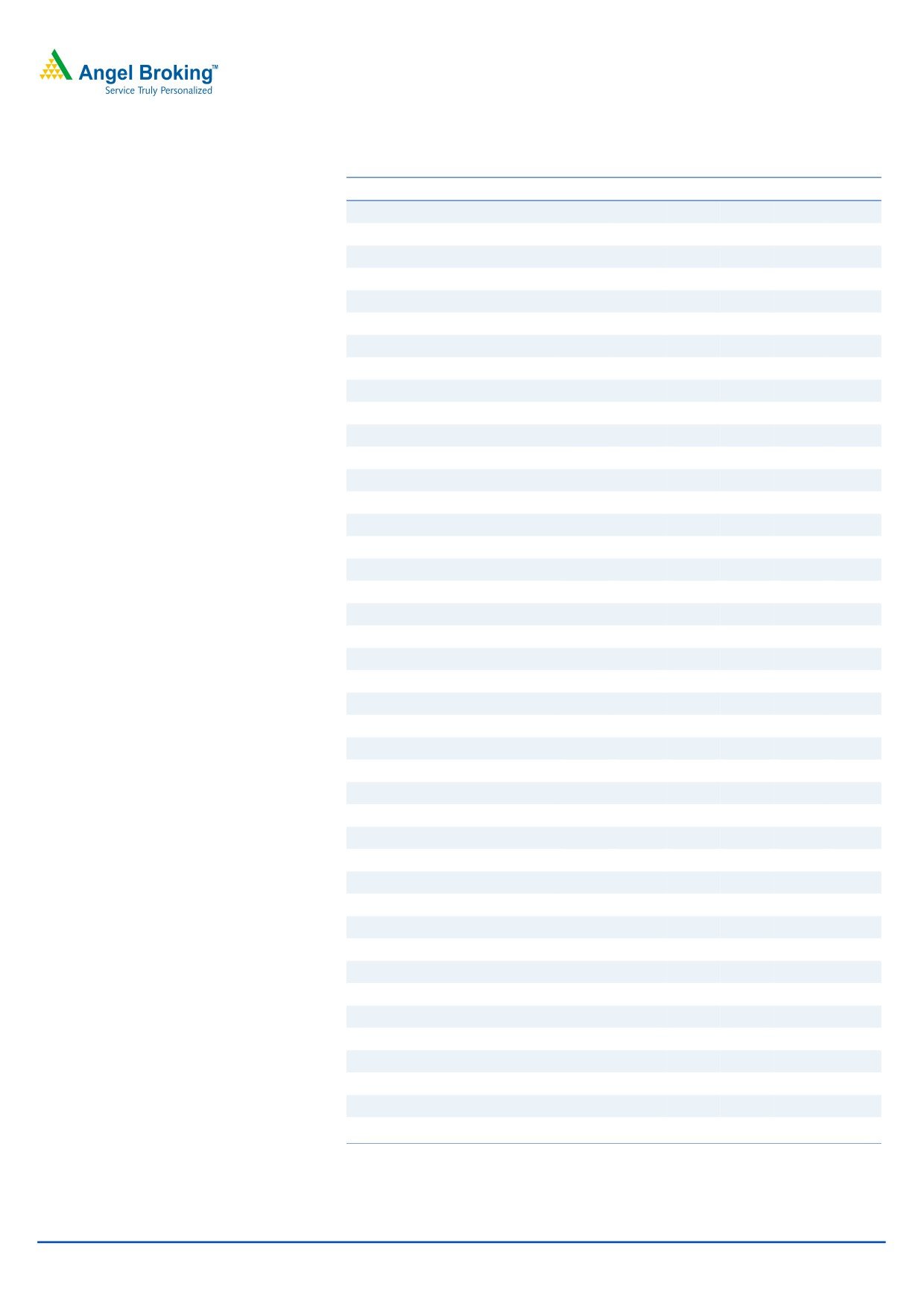

Stock Info

Siyaram, Mistair, J Hamstead and Oxemberg in its kitty.

Sector

Textiles

Strong brand presence: SSM has built a strong brand presence in the country

Market Cap (` cr)

337

through continuous advertisement and brand-building efforts over the past 30

Beta

0.7

years. The company has created a niche for itself in a highly competitive industry.

52 Week High / Low

450/150

SSM enjoys a dominant position for its fabric segment under the Siyaram brand,

Avg. Daily Volume

21,685

which constitutes nearly 83% of its revenue.

Face Value (`)

10

Wide distribution network across India: SSM has one the largest distribution

BSE Sensex

19,451

networks in Tier-II&III cities across the country. The company has a strong network

Nifty

5,842

of over 1,500 dealers and 500 agents supplying to more than 40,000 outlets

Reuters Code

SIYR.BO

across India. This enables the company to easily launch new products with a high

Bloomberg Code

SIYA@IN

success ratio and low marketing cost, giving it an edge over competitors.

Higher utilisation and capacity expansion to drive growth: SSM’s yarn segment is

expected to achieve 60% capacity utilisation in FY2011, compared to 41.9% in

Shareholding Pattern (%)

FY2009, which is further expected to improve to 80% in FY2012E. In the fabric

Promoters

67.0

segment, the company plans to add 286 looms (479 current looms) in a phased

MF / Banks / Indian Fls

8.6

manner over FY2011-13. SSM will also be adding

400 machines in its

FII / NRIs / OCBs

0.0

readymade garment (RMG) segment by September 2011. Consequently, the

Indian Public / Others

24.4

company is expected to report a 17.5% CAGR in revenue over FY2011-13.

Outlook and valuation: SSM generates 75% of its revenue through Tier-II&III

cities. Thus, the company is expected to benefit greatly from the growing

Abs. (%)

3m 1yr

3yr

middle-class population in the country, especially in small towns, and the shift in

Sensex

(1.2)

9.8

24.8

preference towards branded products. Moreover, the timely capacity expansion

Siyaram Silk Mills

7.2

118.7

264.0

will help SSM to take full advantage of the growing demand in India. The stock is

currently trading at 5.2x FY2013E earnings (as against its historical median of 6x

one-year forward EPS). We Initiate Coverage on SSM with an Accumulate

recommendation and a target price of `414, valuing the stock at 6x FY2013E

earnings.

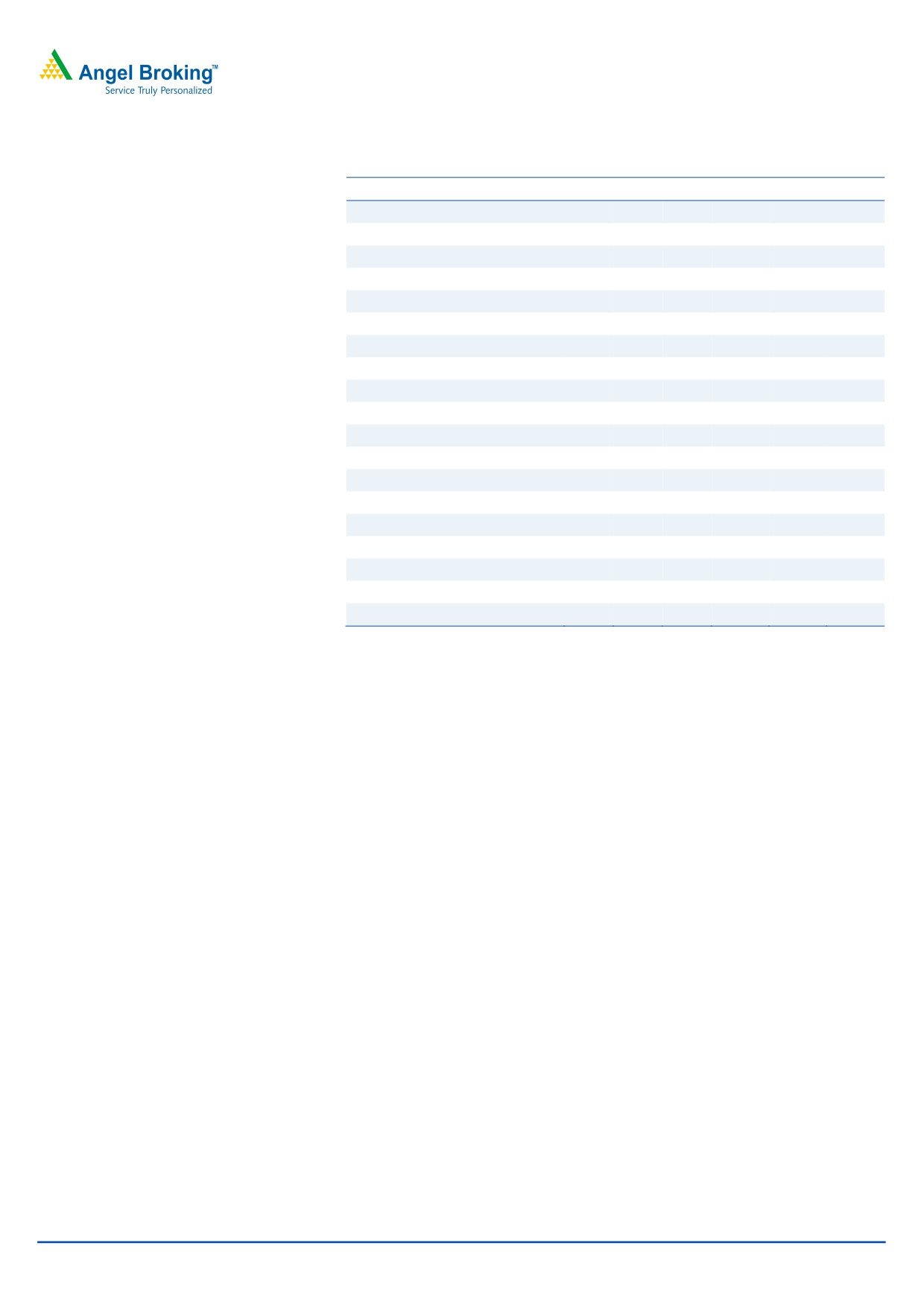

Key financials

Y/E Mar. (` cr)

FY2010 FY2011E FY2012E FY2013E

Net sales

660

838

982

1,150

% chg

24.4

27.1

17.2

17.0

Net profit

34

56

60

65

% chg

194.2

65.5

7.3

8.1

FDEPS (`)

36

59

64

69

EBITDA margin (%)

10.6

12.9

12.2

11.6

P/E (x)

10.0

6.1

5.6

5.2

RoE (%)

21.6

29.0

25.1

22.4

RoCE (%)

13.0

19.8

17.7

17.4

P/BV (x)

2.0

1.6

1.3

1.1

Sharan Lillaney

EV/Sales (x)

0.8

0.7

0.6

0.5

022-39357800 Ext: 6811

EV/EBITDA (x)

7.5

5.6

5.2

4.6

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Siyaram Silk Mills | Initiating Coverage

Investment arguments

Well-known brand

SSM has built a strong brand presence across India through its continuous

brand-building exercises over the last 30 years. The company spends 3-5% of its

net sales on advertising, which has helped it in creating a niche even in a highly

competitive environment. The company’s strong brand presence differentiates it

from other players and gives it an advantage to even charge a premium for its

products.

The company has signed popular personalities like Mahinder Singh Dhoni and

Hrithik Roshan as brand ambassadors for its brands to connect to the common

people of the country. Such strong branding efforts have given an edge to the

company over the years.

The company’s brands include Siyaram, Mistair and J Hampstead in the fabric

segments and Oxemberg and MSD in RMG segment.

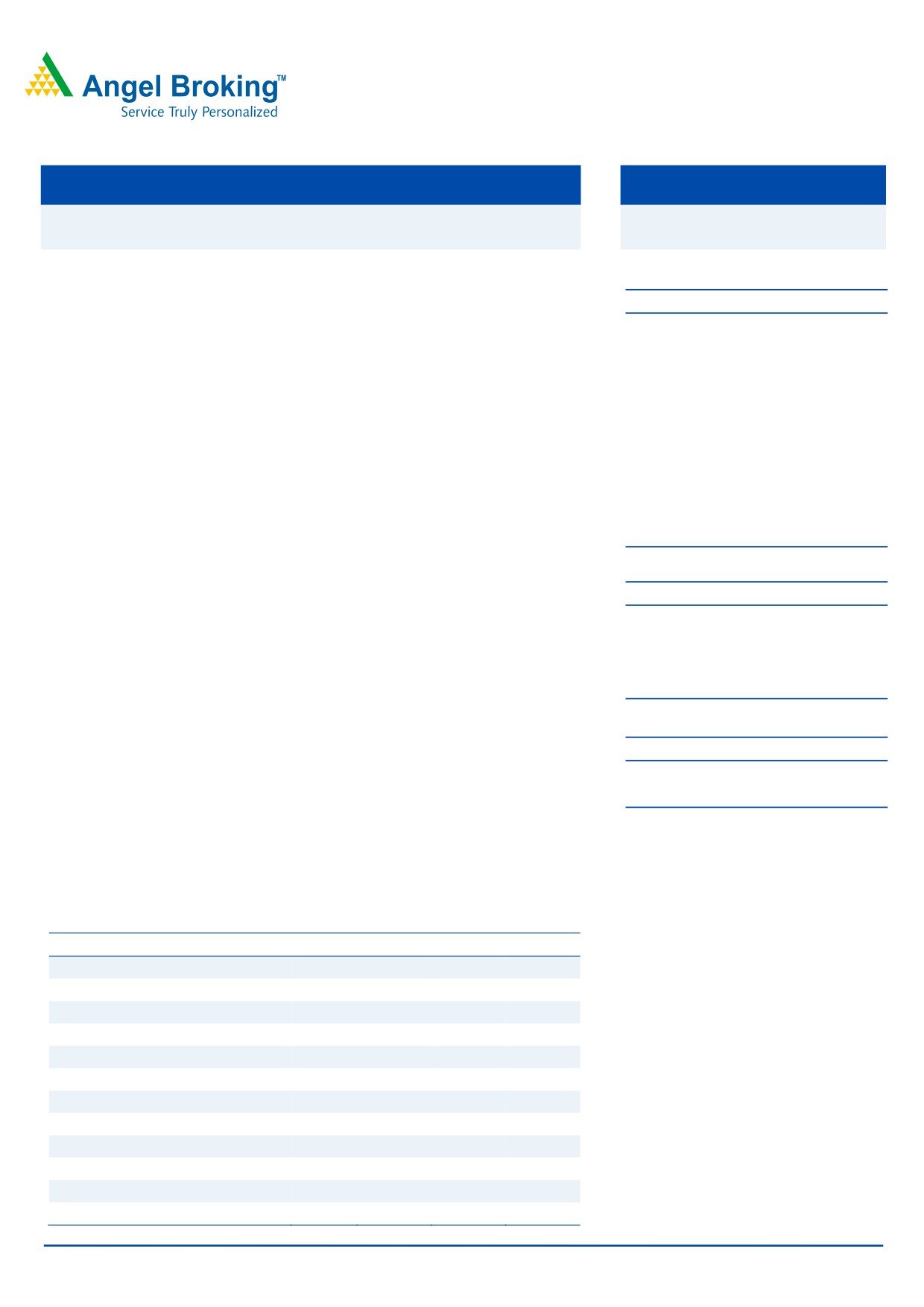

Exhibit 1: Strong focus on advertising

(`cr)

30

28

26

24

24

25

22

20

20

17

16

15

10

5

-

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011E FY2012E FY2013E

Source: Company, Angel Research

Pan-India distribution network - A key advantage

SSM has one of the largest distribution networks in the country. The company has

over 1,500 dealers and 500 agents supplying to over 40,000 outlets across India.

This wide network gives the company a sustainable competitive advantage and

helps it to easily introduce new products with a high success ratio.

April 8, 2011

2

Siyaram Silk Mills | Initiating Coverage

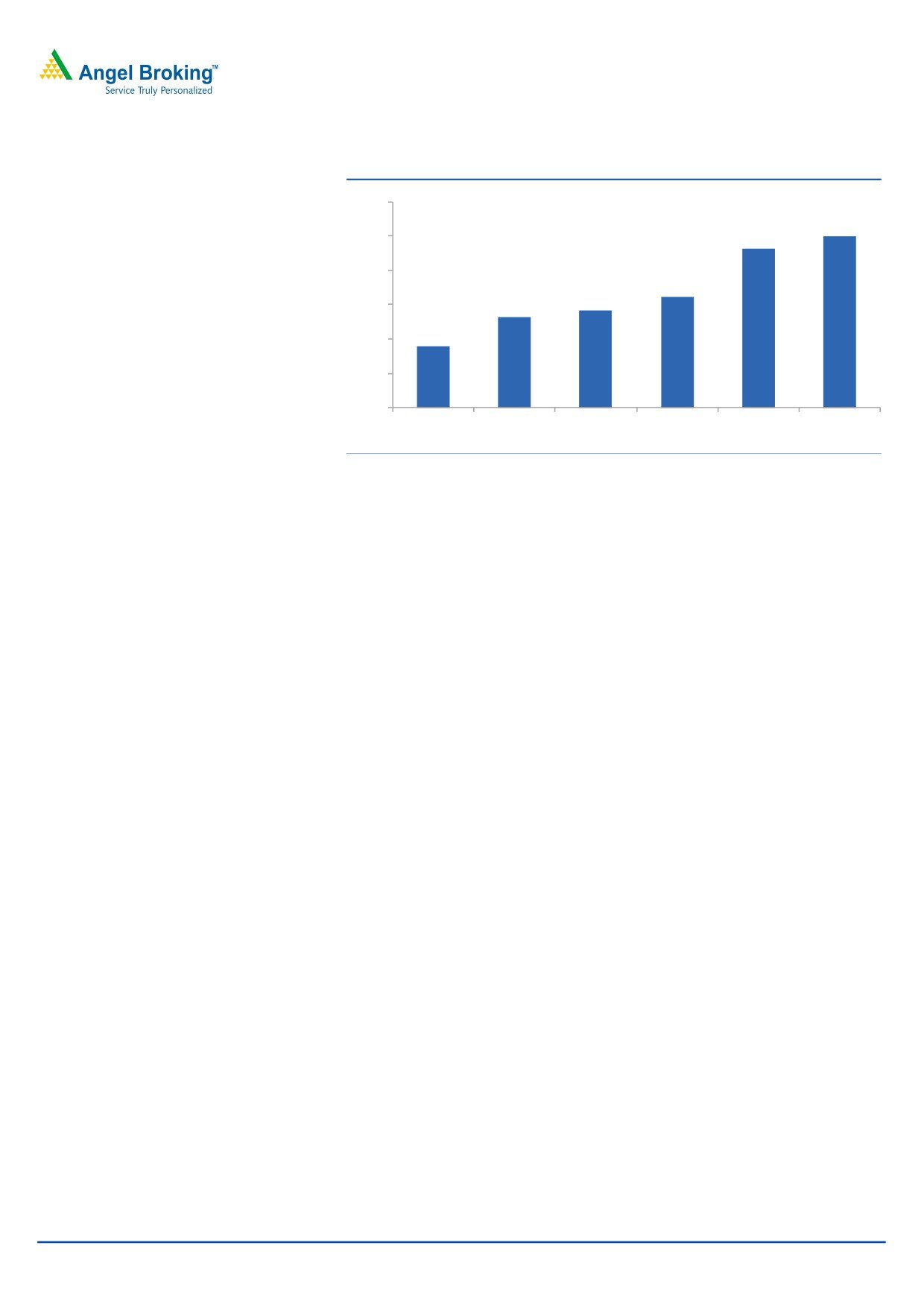

Exhibit 2: Robust growth in the number of agents across India

600

500

500

465

400

325

285

300

265

180

200

100

0

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

Source: Company, Angel Research

Higher utilisation to aid growth and maintain margins

SSM expanded its yarn dyeing capacity at the Tarapur facility to 60mn kgs in

FY2009 from 45mn kgs in FY2008. The company had initially considered setting

up yarn manufacturing and packaging operations at different locations but

decided against it and started building an integrated facility at its Tarapur factory

in FY2009. However, the construction activity was delayed, which adversely

affected the segment’s utilisation level. Nonetheless, the company has completed

the construction activity and the yarn segment is expected to achieve 60% capacity

utilisation for FY2011 compared to 41.9% in FY2010 and is further expected to

achieve 80% capacity in FY2012E.

The utilisation levels of the RMG and fabric segments have also been improving

on the back of strong demand growth. In FY2010, the RMG segment produced

1.7mn pieces with

645 machines. For FY2011, we expect the segment’s

production to increase to around

2.2mn pieces with the same number

of machines.

Better utilisation across all segments will lead to growth in the company’s volume

and revenue, resulting in better profits and margins, as visible in 9MFY2011,

where the company reported a 260bp and 245bp increase in margins to 12.5%

and 6.3% at the EBITDA and PAT level, respectively.

April 8, 2011

3

Siyaram Silk Mills | Initiating Coverage

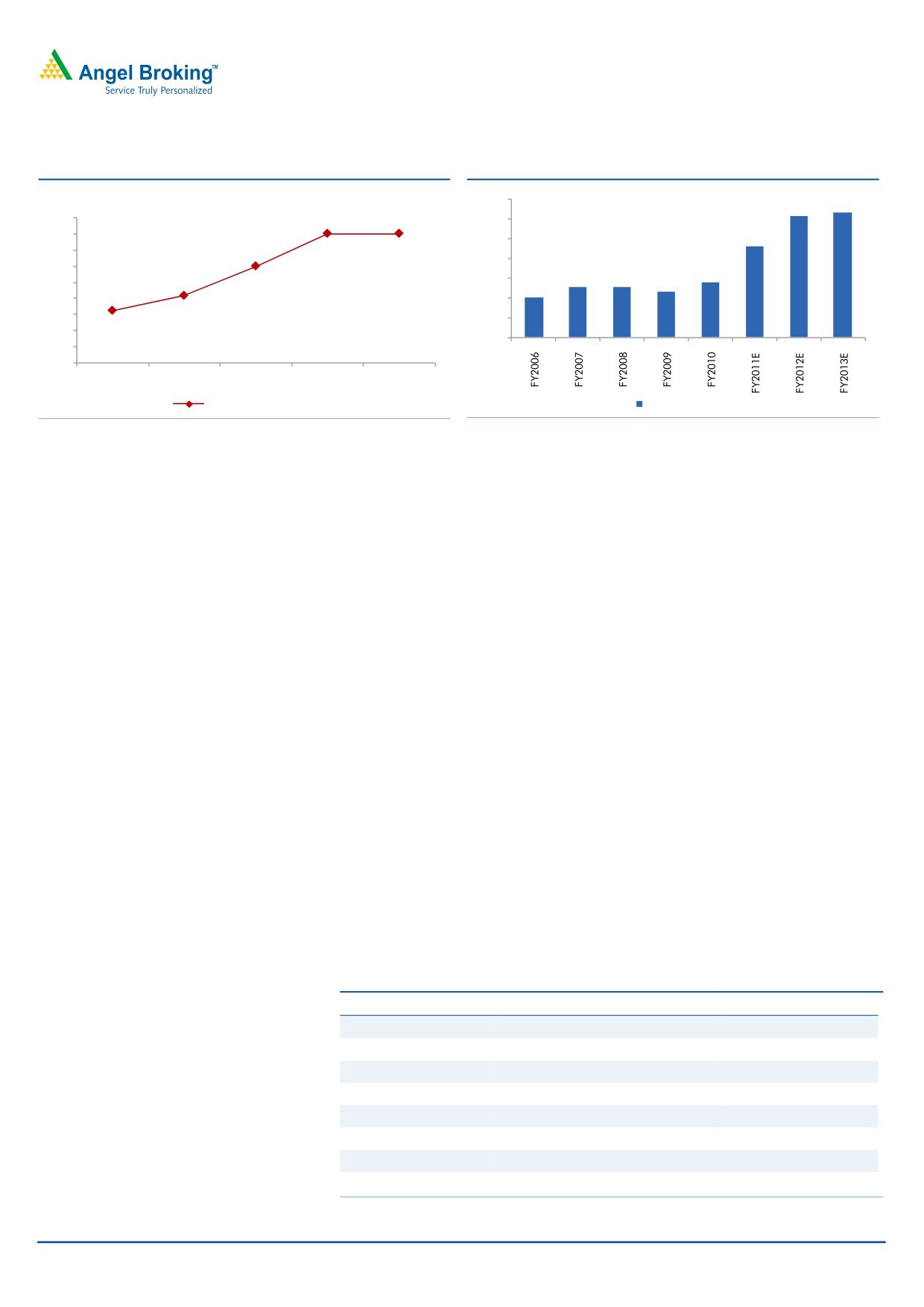

Exhibit 3: Yarn segment’s increasing capacity utilisation

Exhibit 4: ...leading to strong revenue growth

(%)

70

63

61

90

80.0

80.0

60

80

46

50

70

60.0

40

60

28

41.9

30

25

25

23

50

20

32.7

40

20

30

10

20

-

10

0

FY2009

FY2010

FY2011E

FY2012E

FY2013E

Yarn Capacity utilisation

Revenue (`cr)

Source: Company, Angel Research

Source: Company, Angel Research

Capacity expansion to drive growth

SSM is currently on a strong expansion mode to cater to the growing demand for

its products.

SSM has 479 looms and produced 53.1mn mtrs in FY2010 in its fabric segment.

The company plans to add another 286 looms in a phased manner by FY2013,

which will increase its capacity by 26.4mn mtrs/p.a. at full capacity. This capacity

expansion will result in a ~50% increase in volume growth for the segment.

Capacity addition will be done at the Silvassa and Tarapur plants. We expect the

fabric segment to report a 15.1% CAGR in volumes over FY2011-13E to 85.7mn

mtrs in FY2013E from 64.7mn mtrs in FY2011E. In absolute terms, we expect the

fabric segment’s revenue to grow from `680cr in FY2011E to `946cr in FY2013E,

registering a 17.9% CAGR.

The company’s RMG segment has 645 stitching machines currently and is

expected to produce 2.2mn garments in FY2011E. The company plans to add

another 400 stitching machines by 2QFY2012, producing 0.48mn pcs/p.a. at the

Daman plant. This is expected to give the company a 22% volume boost annually.

In absolute terms, over FY2011-13E, we expect SSM’s sales volume to register a

14.9% CAGR to 2.8mn pcs/p.a. and revenue to report a 16.3% CAGR to `128cr.

The total planned capex will be around `198cr, of which `136cr will be utilised for

machinery and `62cr for land and building expansion.

Exhibit 5: Capacity expansion plans

Segment

Period

Planned expansion

Production capacity

Fabric

No. of looms

(mn mtrs/p.a)

Phase 1

2QFY2012

78

7.2

Phase 2

4QFY2012

120

13.2

Phase 3

2QFY2013

88

6.0

Total

2QFY2013

286

26.4

RMG

No. of stitching machines

(pieces/p.a)

Phase 1

2QFY2012

400

480,000

Source: Company, Angel Research

April 8, 2011

4

Siyaram Silk Mills | Initiating Coverage

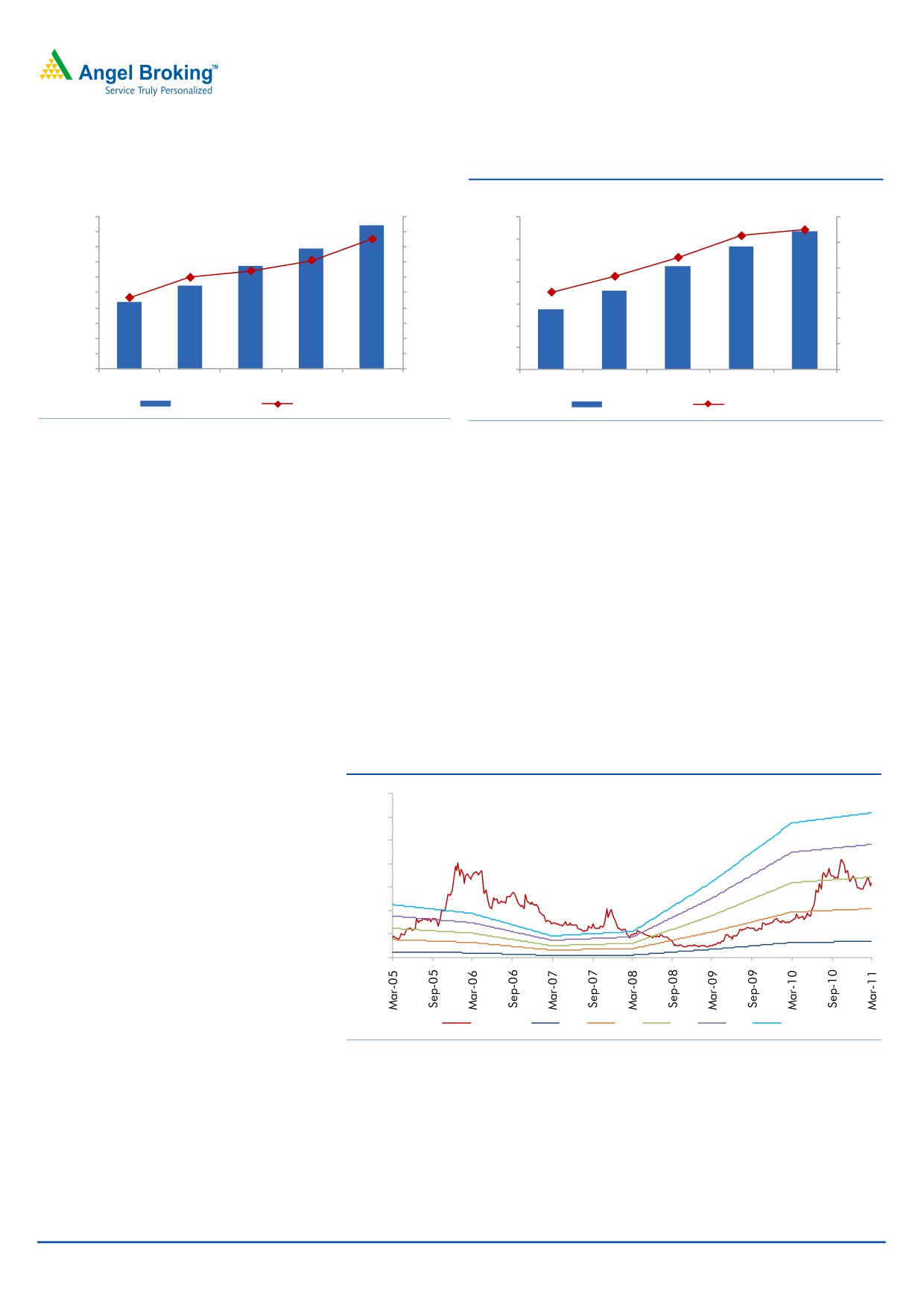

Exhibit 6: Fabric segment - Revenue and volume trend

Exhibit 7: RMG segment - Revenue and volume trend

(`cr)

(mn)

(`cr)

(mn)

2.8

1,000

100

140

2.6

3.0

86

900

90

120

2.2

2.5

72

800

80

65

700

60

70

100

1.8

2.0

600

60

1.5

47

80

500

50

1.5

60

400

40

1.0

300

30

40

200

20

0.5

20

100

441

548

680

792

946

10

55

72

94

113

128

-

-

-

-

FY2009

FY2010

FY2011E

FY2012E FY2013E

FY2009

FY2010

FY2011E

FY2012E

FY2013E

Revenue (LHS)

Fabrics (mtrs)

Revenue (LHS)

RMG (pieces)

Source: Company, Angel Research

Source: Company, Angel Research

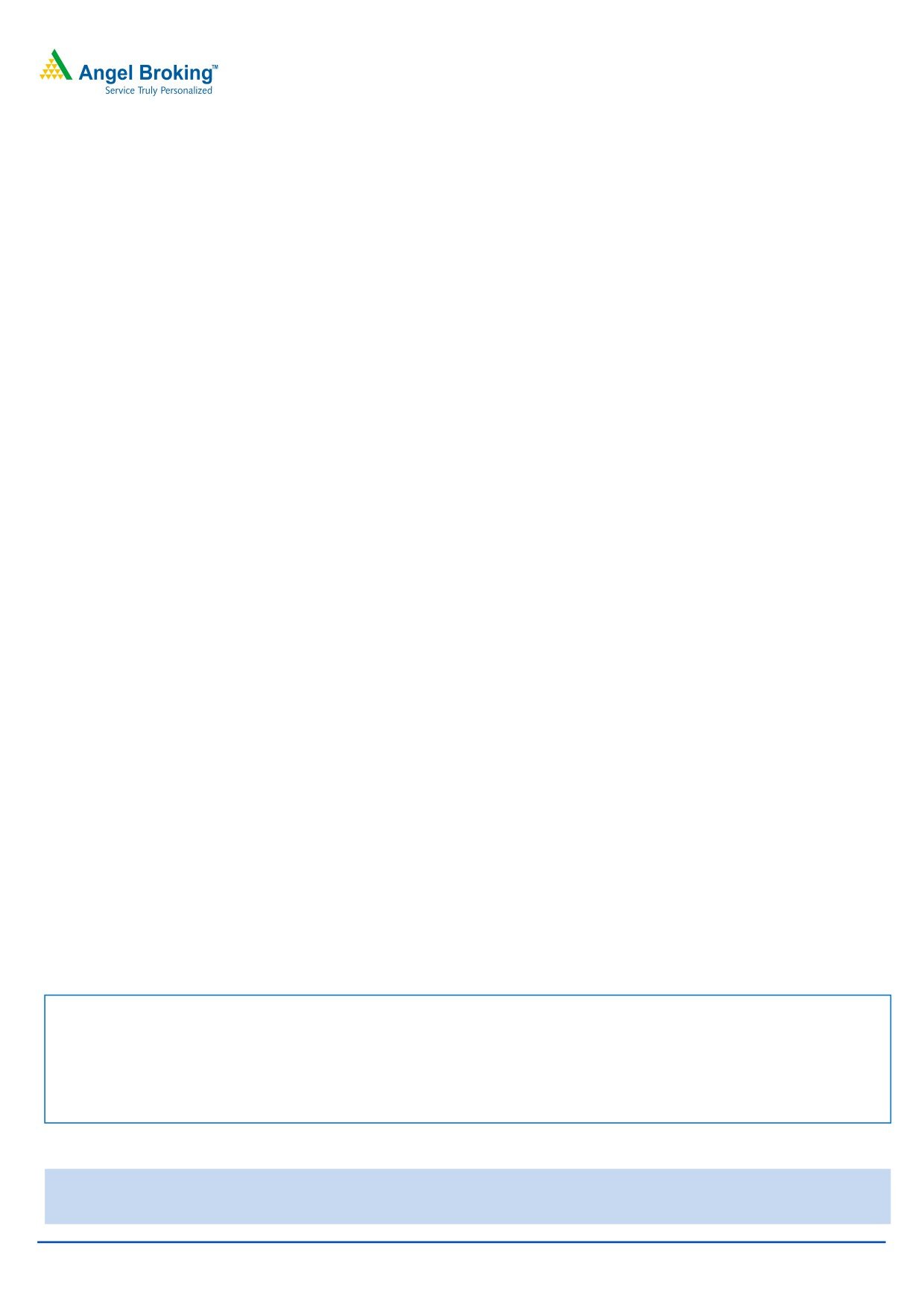

Outlook and valuation

SSM generates 75% of its revenue through Tier-II&III cities. Thus, the company is

expected to benefit greatly from the growing middle-class population in the

country, especially in small towns, and the shift in preference towards branded

products. Further, timely capacity expansion will help the company to take full

advantage of growing demand in India.

With strong growth across all segments, we expect SSM to register a 17.5% CAGR

in revenue. SSM, a dominant player in the industry, has over 20% RoE and is

currently available at an attractive valuation of just 5.2x FY2013E earnings (as

against its historical median of 6x one-year forward EPS). We Initiate Coverage on

the stock with an Accumulate recommendation and a target price of `414, valuing

the stock at 6x FY2013E earnings.

Exhibit 8: One-year forward P/E band

700

600

500

400

300

200

100

0

Price (`)

1x

3x

5x

7x

9x

Source: Company, Angel Research

April 8, 2011

5

Siyaram Silk Mills | Initiating Coverage

Concerns

Competition from the unorganised sector

SSM operates in a highly unorganised sector. The company can face intense

competition from unorganised players as they usually sell their products at a much

cheaper rate compared to SSM. In the organised sector, the company’s products

are cheaper than peers. However, we believe due to strong branding efforts and a

huge distribution network, the company has been easily able to differentiate its

products from those of competitors.

Delay in capacity expansion

SSM is expected to increase its fabric capacity by ~50% by adding 400 stitching

machines by 2QFY2012. Any delay in capacity expansion plans due to unforeseen

reasons can have a negative impact on the company’s revenue growth and

profitability.

Fluctuations in raw-material prices

SSM operates in a highly price-sensitive market. Any fluctuation in raw-material

prices can lead to margin compression, as the company may not be able to pass

on the entire increase to the end-user. However, we believe SSM’s ability to pass

on the increase is partly aided by its strong brand presence and a large client

base. For instance, in 9MFY2011, despite the substantial increase in raw-material

prices, the company did not face any margin pressure.

April 8, 2011

6

Siyaram Silk Mills | Initiating Coverage

Financial overview

In FY2010, SSM registered strong growth of 24.4% yoy in revenue, largely due to

improved economic conditions as well as capacity expansion. The company

continued to report strong performance in FY2011, registering robust 29.4% yoy

growth in revenue for 9MFY2011 to `613cr from `474cr in 9MFY2010, aided by

strong realisations and higher utilisation.

For 4QFY2011E, we expect strong growth to continue across all segments,

especially the fabrics and yarn segments, on the back of higher utilisation. For

FY2011, we expect strong top-line growth of `179cr (27.1%) yoy to `838cr

compared to `660cr in FY2009, largely due to strong growth across all segments

(fabrics, RMG and yarn), which are expected to post 24.2%, 30.4% and 66% yoy

growth, respectively. Further, we expect all segments to register strong growth on

account of robust demand and shift in consumer preference towards banded

products.

Going ahead, we expect the company's top line to register a 17.5% CAGR over

FGY2011-13E, increasing to `982cr in FY2012 and `1,150cr in FY2013.

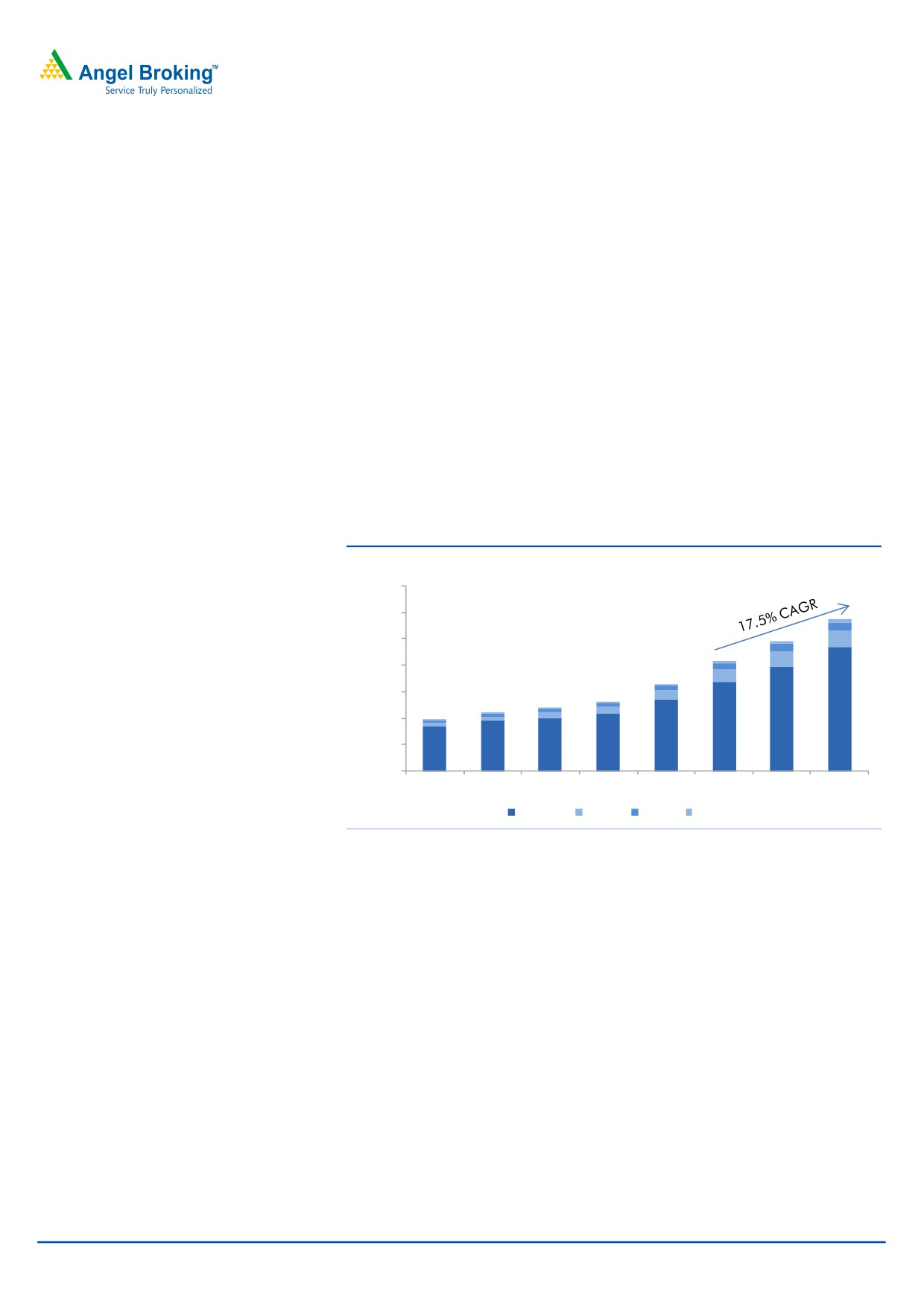

Exhibit 9: Strong growth trajectory

(`cr)

1,400

1,200

1,000

800

600

400

200

0

FY2006

FY2007

FY2008

FY2009

FY2010 FY2011E FY2012E FY2013E

Fabrics

RMG Yarn Others

Source: Company, Angel Research

EBITDA margins to remain in line

For FY2010, SSM’s operating margin improved to 10.6% (8.0%), largely on the

back of lower operating expenses, which came down to 19.4% of revenue in

FY2010 versus 21.8% in FY2009. However, for 9MFY2011, the company’s

operating margin increased by 260bp to 12.5% yoy due to higher utilisation and

strong ability of the company to pass on any increase in raw-material prices

without any margin erosion.

SSM’s EBITDA margin has been improving qoq from 11.5% in 1QFY2011 to

12.7% in 2QFY2011 and 13.1% in 3QFY2011. The company’s margin is further

expected to improve to 13.8% in 4QFY2011E, as historically margins have always

been strongest in 4Q. For FY2011E, we estimate the company to report EBITDA

margin of 12.9%. Conservatively, keeping a margin of safety on the back of the

company’s historical margins, we expect EBITDA margin to slightly come down to

12.2% and 11.6% in FY2012E and FY2013E, respectively. EBITDA is estimated to

increase from `70cr in FY2010 to `133cr in FY2013E on the back of strong

revenue growth.

April 8, 2011

7

Siyaram Silk Mills | Initiating Coverage

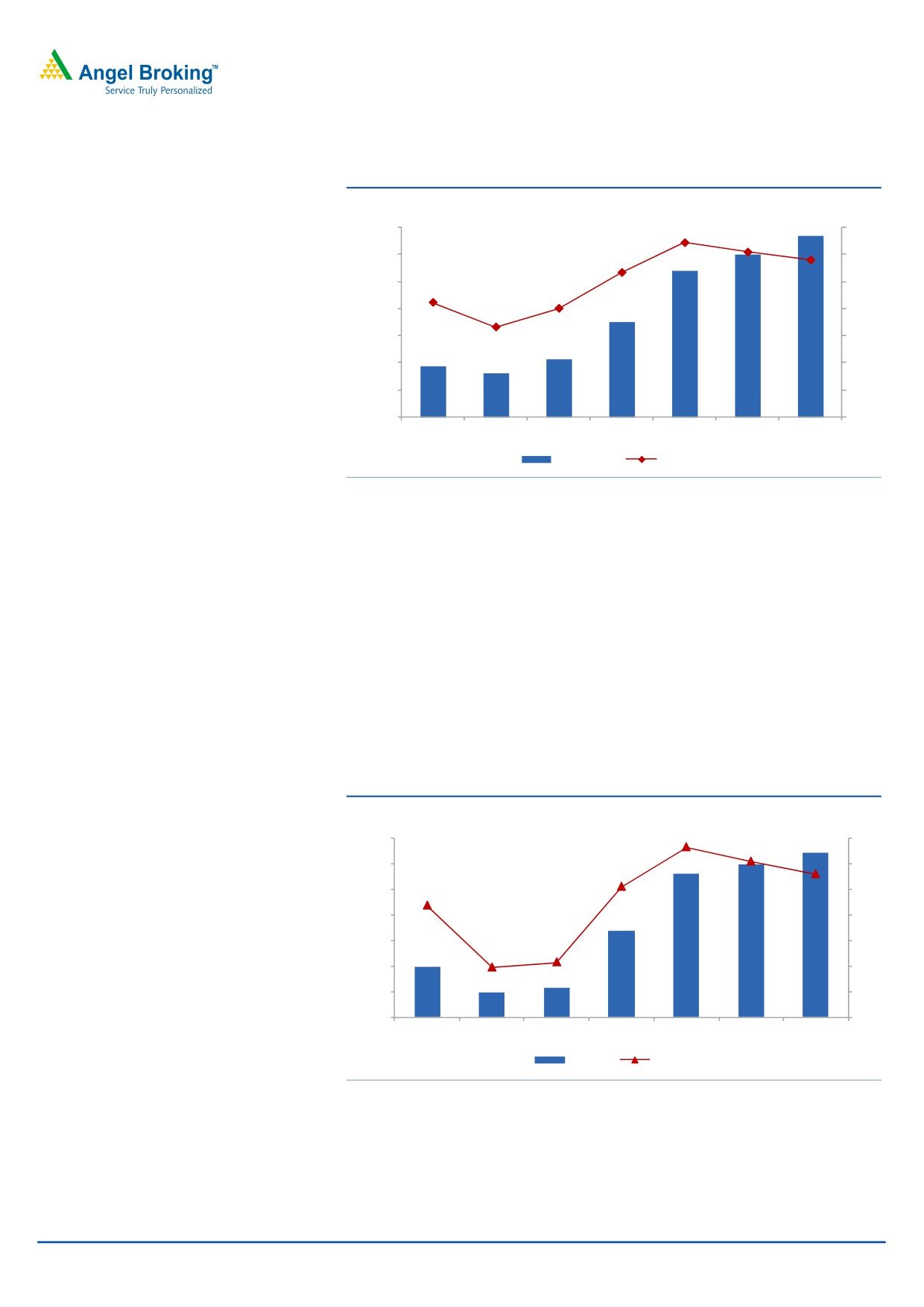

Exhibit 10: EBITDA margin to stabilise

(`cr)

(%)

140

12.9

14

12.2

11.6

120

10.6

12

10

100

8.4

8.0

80

6.6

8

60

6

40

4

20

2

38

32

42

70

108

119

133

-

0

FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

EBITDA

Margin

Source: Company, Angel Research

Net profit to register a 24.1% CAGR over FY2010-13E

In FY2010, SSM’s net profit margin increased by 294bp to 5.1% (2.2%), primarily

because of higher operating margins during the year. For FY2011, we estimate net

profit margin to increase substantially to 6.6% (5.1%) on the back of strong EBITDA

margin expansion. For 9MFY2011, net profit surged by 110.9% yoy to `39cr from

`18cr in 9MFY2010 due strong revenue growth as well as margin expansion.

Thus, net profit is expected to increase to `56cr in FY2011 from `34cr in FY2010.

For FY2012 and FY2013, we estimate net profit margin to marginally decline to

6.1% and 5.6% to `60cr and `64cr, respectively, on the back of a decline in

EBITDA margin. Overall, the company is expected to register a 24.1% CAGR in

PAT over FY2010-13E.

Exhibit 11: PAT to increase steadily

(`cr)

(%)

6.6

70

5.6

7

6.1

60

6

5.1

50

4.4

5

40

4

30

2.2

3

2.0

20

2

10

1

20

10

11

34

56

60

64

-

0

FY2007 FY2008 FY2009 FY2010 FY2011E FY2012E FY2013E

PAT

Margin

Source: Company, Angel Research

April 8, 2011

8

Siyaram Silk Mills | Initiating Coverage

Company background

SSM is a part of the Siyaram-Poddar Group. The company began operating in

1978 as a fabric manufacturer and eventually diversified into the RMG segment.

The company is one of the most renowned vertically integrated textile companies in

India. The company’s plants are located at Daman, Silvassa and Tarapur.

SSM operates mainly in two branded segments - fabrics and RMG. In the fabrics

segment, the company sells its products under popular brands Siyaram, Mistair

and J Hampstead, catering to the low, medium and premium segments,

respectively. The RMG segment has two major brands MSD (casual wear) and

Oxemberg (formal wear), which cater to the medium segment. The company also

has an unbranded segment, the yarn dyeing segment.

Other group companies of the Siyaram-Poddar Group include Balkrishna

Industries and Govind Rubber.

April 8, 2011

9

Siyaram Silk Mills | Initiating Coverage

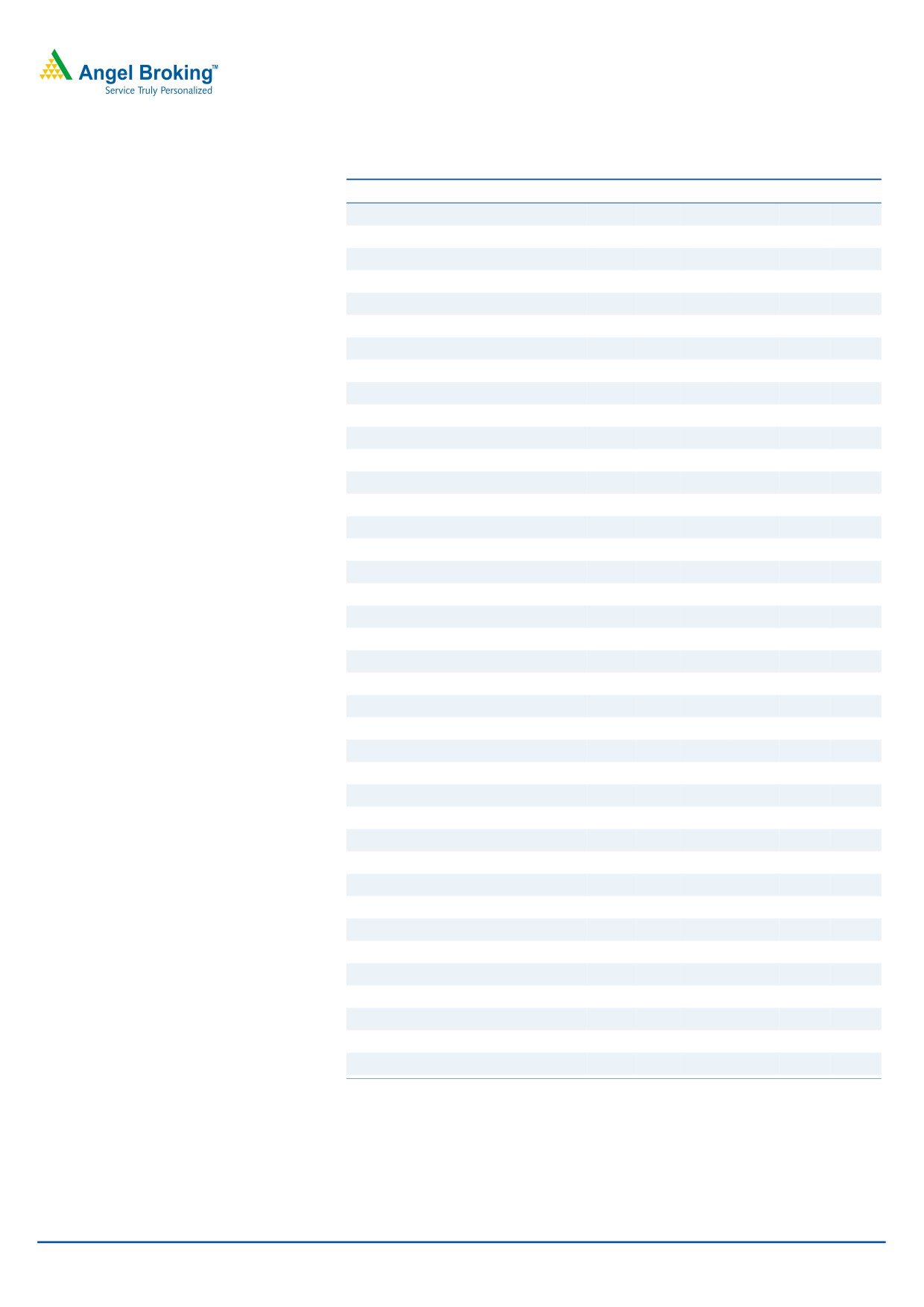

Profit & loss statement

Y/E Mar. (` cr)

FY08

FY09

FY10

FY11E

FY12E

FY13E

Net sales

486

530

660

838

982

1,150

% chg

8.8

9.1

24.4

27.1

17.2

17.0

Total expenditure

454

488

589

730

863

1,017

Consumption of raw materials

211

209

258

369

427

500

Employee cost

30

33

39

48

56

66

Other expenditure

114

116

128

168

188

216

Processing, excise & labour charges

69

70

84

106

124

145

Purchase of traded goods

62

48

71

93

103

115

Other

-

-

-

-

-

-

EBITDA

32

42

70

108

119

133

% chg

(14.8)

32.0

66.1

53.5

10.8

11.4

(% of net sales)

6.6

8.0

10.6

12.9

12.2

11.6

Depreciation & amortisation

17

19

20

21

25

31

EBIT

15

23

50

87

95

102

% chg

(29.8)

49.3

116.5

73.4

9.3

7.8

(% of net sales)

3.2

4.4

7.6

10.4

9.7

8.9

Interest & other charges

10.7

16.8

12

13

16

17

Adj. other income

7.5

8.4

11

8

8

9

(% of PBT)

61.1

57.1

22.3

9.8

9.6

9.3

Share in profit of associates

-

-

-

-

-

-

Recurring PBT

12

15

49

81

87

94

% chg

(47.0)

19.5

234.6

65.9

7.3

8.1

Extraordinary expense/(inc.)

-

-

-

-

-

-

PBT (reported)

12

15

49

81

87

94

Tax

2.7

3.2

15

26

27

30

(% of PBT)

22.4

21.9

31.3

31.5

31.5

31.5

PAT (reported)

10

11

34

56

60

65

Add: Share of earnings of associate

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

% chg

(51.3)

20.4

194.2

65.5

7.3

8.1

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

10

11

34

56

60

65

Extraordinary income post tax

-

-

-

-

-

-

ADJ. PAT

10

11

34

56

60

65

% chg

(51.3)

20.4

194.2

65.5

7.3

8.1

(% of Net sales)

2.0

2.2

5.1

6.6

6.1

5.6

Basic EPS (`)

10.1

12.2

35.9

59.4

63.8

69.0

Fully diluted EPS (`)

10.1

12.2

35.9

59.4

63.8

69.0

% chg

(51.3)

20.4

194.2

65.5

7.3

8.1

April 8, 2011

10

Siyaram Silk Mills | Initiating Coverage

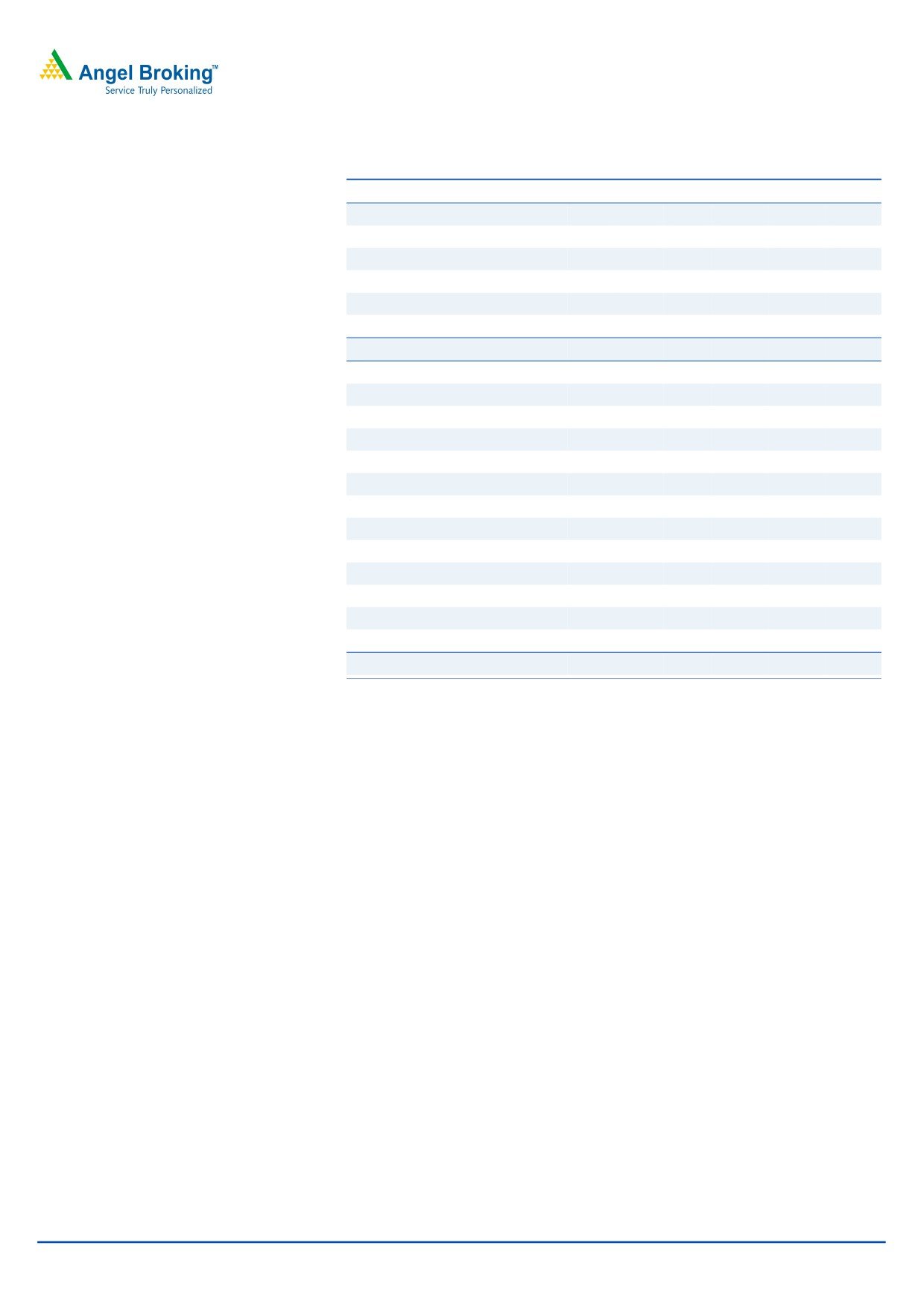

Balance sheet

Y/E Mar. (` cr)

FY08 FY09 FY10 FY11E FY12E FY13E

SOURCES OF FUNDS

Equity share capital

9.4

9.4

9.4

9.4

9.4

9.4

Reserves & surplus

127

133

160

205

253

305

Shareholders’ funds

136

142

170

214

262

314

Total loans

270

233

190

269

289

274

Deferred tax liability

17

18

18

18

18

18

Total Liabilities

424

393

378

501

569

605

APPLICATION OF FUNDS

Gross block

303

325

337

338

438

538

Less: Acc. depreciation

101

120

137

158

183

214

Net block

201

205

200

180

255

324

Capital work-in-progress

5

2

-

100

75

-

Investments

-

-

28

17

17

17

Current assets

276

248

251

320

358

414

Cash

1.1

2.1

2.9

2.0

2.3

2.2

Loans & advances

33

34

42

56

56

56

Inventories

109

97

89

133

151

183

Debtors

133

114

117

128

149

173

Current liabilities

58

61

102

115

136

149

Net current assets

218

186

149

205

222

265

Total assets

424

393

378

501

569

605

April 8, 2011

11

Siyaram Silk Mills | Initiating Coverage

Cash flow statement

Y/E Mar. (` cr)

FY08 FY09 FY10 FY11E FY12E FY13E

Profit before tax

12

15

49

81

87

94

Depreciation

17

19

20

21

25

31

Change in working capital

(42)

34

46

(42)

(17)

(43)

Less: Other income

7

8

11

8

8

9

Direct taxes paid

3

3

15

26

27

30

Cash flow from operations

(24)

56

89

26

59

44

Inc./(Dec.) in fixed assets

(44)

(19)

(11)

(100)

(75)

(25)

Inc./(Dec.) in investments

(0)

0

(28)

12

-

-

Inc./(Dec.) in loans and adv.

(12)

(1)

(8)

(14)

-

-

Other income

7

8

11

8

8

9

Cash flow from investing

(48)

(12)

(36)

(94)

(67)

(16)

Issue/(buy back) of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

77

(38)

(43)

79

20

(15)

Dividend paid (Incl. tax)

(5)

(5)

(7)

(11)

(12)

(13)

Others

(0)

0

(2)

(1)

-

-

Cash flow from financing

71

(43)

(52)

67

8

(28)

Inc./(Dec.) in cash

(0.3)

1.0

0.8

(0.9)

0.3

(0.1)

Opening cash balances

1.4

1.1

2.1

2.9

2.0

2.3

Closing cash balances

1.1

2.1

2.9

2.0

2.3

2.2

April 8, 2011

12

Siyaram Silk Mills | Initiating Coverage

Key ratios

Y/E Mar.

FY08 FY09 FY10

FY11E

FY12E

FY13E

Valuation Ratio (x)

P/E (on FDEPS)

35.5

29.5

10.0

6.1

5.6

5.2

P/E (on basic, reported EPS)

35.5

29.5

10.0

6.1

5.6

5.2

P/CEPS

12.9

11.0

6.3

4.4

4.0

3.5

P/BV

2.5

2.4

2.0

1.6

1.3

1.1

Dividend yield (%)

1.4

1.4

1.7

2.8

3.0

3.3

Market cap. / Sales

0.7

0.6

0.5

0.4

0.3

0.3

EV/Sales

1.2

1.1

0.8

0.7

0.6

0.5

EV/EBITDA

18.9

13.4

7.5

5.6

5.2

4.6

EV / Total assets

1.4

1.4

1.4

1.2

1.1

1.0

Per share data (`)

EPS (basic)

10.1

12.2

35.9

59.4

63.8

69.0

EPS (fully diluted)

10.1

12.2

35.9

59.4

63.8

69.0

Cash EPS

27.8

32.7

57.5

81.9

90.1

101.9

DPS

5

5

6

10

11

12

Book value

145.5

151.8

181.2

228.8

279.7

334.9

DuPont analysis (%)

EBIT margin

3.2

4.4

7.6

10.4

9.7

8.9

Tax retention ratio

77.6

78.1

68.7

68.5

68.5

68.5

Asset turnover (x)

1.3

1.3

1.8

2.0

1.9

2.0

ROIC (Post-tax)

3.1

4.4

9.3

14.3

12.6

12.3

Cost of debt (Post tax)

3.6

5.2

3.9

4.0

3.9

4.1

Leverage (x)

1.7

1.8

1.2

1.1

1.1

0.9

Operating ROE

2.4

3.1

16.0

25.2

21.7

19.7

Returns (%)

ROCE (Pre-tax)

4.0

5.7

13.0

19.8

17.7

17.4

Angel ROIC (Pre-tax)

4.2

5.7

13.6

23.8

22.1

19.3

ROE

7.1

8.2

21.6

29.0

25.1

22.4

Turnover ratios (x)

Asset turnover (Gross block)

1.8

1.7

2.0

2.5

2.5

2.4

Asset turnover (Net block)

2.8

2.6

3.3

4.4

4.5

4.0

Asset turnover (Total assets)

1.3

1.3

1.7

1.9

1.8

2.0

Opt. income / Invested capital

1.3

1.3

1.8

2.0

1.9

2.0

Inventory / Sales (days)

69

71

52

48

53

53

Receivables (days)

98

85

64

53

51

51

Payables (days)

45

41

45

47

47

45

W.C. cycle (days)

142

138

91

76

78

77

Solvency ratios (x)

Gross debt to equity

2.0

1.6

1.1

1.3

1.1

0.9

Net debt to equity

2.0

1.6

0.9

1.2

1.0

0.8

Net debt to EBITDA

8.4

5.5

2.3

2.3

2.3

1.9

Interest Coverage (EBIT / Int.)

3.0

2.5

5.9

8.0

7.5

8.0

April 8, 2011

13

Siyaram Silk Mills | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Siyaram Silk Mills

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

April 8, 2011

14

Siyaram Silk Mills | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093.

Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Shailesh Kanani

Infrastructure

Param Desai

Real Estate, Logistics, Shipping

Sageraj Bariya

Fertiliser, Mid-cap

Srishti Anand

IT, Telecom

Bhavesh Chauhan

Metals, Mining

Jai Sharda

Mid-cap

Sharan Lillaney

Mid-cap

Naitik Mody

Mid-cap

Chitrangda Kapur

FMCG, Media

Amit Vora

Research Associate (Oil & Gas)

V Srinivasan

Research Associate (Cement, Power)

Mihir Salot

Research Associate (Logistics, Shipping)

Pooja Jain

Research Associate (Metals & Mining)

Yaresh Kothari

Research Associate (Automobile)

Shrinivas Bhutda

Research Associate (Banking)

Sreekanth P.V.S

Research Associate (FMCG, Media)

Hemang Thaker

Research Associate (Capital Goods)

Nitin Arora

Research Associate (Infra, Real Estate)

Ankita Somani

Research Associate (IT, Telecom)

Varun Varma

Research Associate (Banking)

Vasant Lohiya

Research Associate (Banking)

Poonam Sanghvi

Research Associate (Pharmaceutical)

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Mileen Vasudeo

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Jaya Agarwal

Derivative Analyst

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Abhimanyu Sofat

AVP - Institutional Sales

Pranav Modi

Sr. Manager

Jay Harsora

Manager

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Production Team:

Simran Kaur

Research Editor

Bharat Patil

Production

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

April 8, 2011

15